What is a Special District?

What is a Special District

“Independent, special purpose governmental units (other than school districts) that exist as separate entities with substantial administrative and fiscal independence from general-purpose governments” (U.S. Census Bureau, 1994, p.23). “Legally constituted governmental entities…that are neither cities, counties, redevelopment agencies, or schools” (Office of the California State Controller, 1994, p.2).

Understanding Special Districts

One way to understand special districts is to look at their activities, funding, and governance.

Activities

Nearly 85% of California’s special districts are single function districts, which provide only one service such as fire protection, mosquito abatement, or waste disposal. The remaining districts are multi-function districts providing two or more services. For example, several municipal utility districts provide fire protection and park services in addition to utility services. Fire protection districts often provide ambulance services too. County Service Areas (CSAs) can provide any service that a county can provide. A district’s name does not always indicate which services it provides or is authorized to provide.

Funding

Special districts generate revenue from several sources including property taxes, special assessments, and fees. • Enterprise districts run much like business enterprises and provide specific benefits to their customers. These districts are primarily funded by the fees that customers pay for services.

• Non-enterprise districts deliver services that provide general benefits to entire communities. These services, such as fire protection, flood control, cemeteries, and road maintenance, do not lend themselves to fees. Nonenterprise districts rely primarily on property taxes for their revenues.

Governance

There are two forms of special district governance:

• About 2/3 of special districts are independent districts with independently elected boards or appointed boards whose directors serve for fixed terms. Most have five-member boards but they vary with the size and nature of the district. Cemetery, Fire Protection, and Community Services Districts are mostly independent districts.

• The other 1/3 of special districts are dependent districts governed by either a city council or county board of supervisors. County Service Areas are dependent districts.

How is Arcata Fire District Funded?

Arcata Fire District is an indedpendent district that is funded by about 40% from property tax. 55% of revenue comes from a combination of a 2006 special assessment and Measure F, a 2020 special tax, both approved by the voters of the district.

1.) MEASURE F SPECIAL TAX (APPROXIMATELY 55% OF FUNDING)

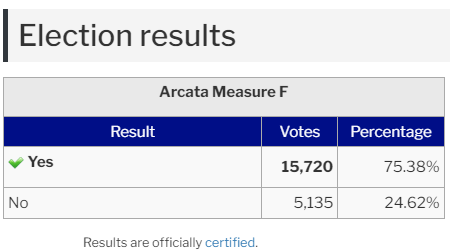

Measure F is an Ordinanace that began in the fiscal year 2020-21, which adjusted the rate of our fire protection special tax in order to continue to provide quality local fire protection, rescue and other essential services provided by our District.

Taken from the 'Arcata Fire Protection District Special Tax Full Text':

"The special tax shall be collected in the same manner and subject to the same penalty as, or with, other taxes fixed and collected by Humboldt County on behalf of the Arcata Fire Protection District. ... This Ordinance shall be effective only at such time as the District Baord has declared that the Ordinance has been approved by two-thirds of the voters voting at an election to be held on November 3, 2020. Should theis Ordinance not be approved, Ordinance No 97-010 (approved by voters in 1997) will remain in full force and effect. ...if this Ordinance is approved, the special tax will be collected at the rates established by this Ordinance beginning with the 2020-2021 fiscal year until June 30, 2030, at which time the special l tax shall be repealed by operation of law, unless extended in accordance with law."

For full document text, click here: Measure F - Full Text

2.) 2006 BENEFIT ASSESSMENT ( APPROXIMATEDLY 40% OF FUNDING)

Taken from the 'An Ordinance of the Arcata Fire Protection District Establishing a Benefit Assessment to Finance Fire Protection and Prevention Services':

"The express purpose for which this Benefit Assessment is levied is to establish a stable source of supplementary funds to obtain, furnish, operate and maintain fire suppression equipment or apparatus, or for the purpose of paying the salaries and benefits of firefighting and prevention personnel, or both, wherther or not fire supporession or prevention services are actually used by or upon a parcel, improvement, or property. ... Any funds collected from the Benefit Assessment authorized by this ordinance shall be expended only for such fire suppression and prevention services whithin the District. ...On July 20, 2006, The District Board of Directors ("Board") conducted a public hearing upon the establishment of the Benefit Assessment levied by this ordinance. Of the ballots received prior to the end of the public hearing, the number of ballots in opposition did not exceed the number of ballots in favor."

For full document text, click here: Establishing Benefit Assessment Document

How Many Special Districts are there in California,

Compared to Other Forms of Government?

- 58 Counties

- 470 Cities

- 380 Redevelopment Agencies

- 1,100 School Districts

- 4800 Special Districts

What Laws Govern Special Districts?

All State and Federal Laws apply. Additionally, the following laws are particularly important for special districts.

- The Cortese-Knox Act

- The Brown Act

- The Bergeson Fire District Law